Ultimate guide to deposits and partial payments on Shopify

Jul 19, 2023

In this guide we’ll go through deposits on Shopify and how they can increase flexibility for customers and enable more sales using a variety of different selling strategies.

Table of Contents

1. Introduction

- Made to order

- Preorders

- B2B Wholesale

- Reserve now, pay later

- Try now, pay later

- Raffles for limited drops

- Dropshipping

- Services

- Games and Toys

- Home and Garden

- Farm Fresh Goods

- Consumer electronics

- Build hype early

- Writing a clear cancellation policy

- Communicating with your customers

- Changing language on your Checkout page

- Offering Incentives

- Use a variety of payment options to give customers more flexibility

- Final thoughts

Introduction

In today’s competitive e-commerce landscape, gaining an edge by finding new selling strategies has become key to boosting sales and improving customer satisfaction. While offering deposits or deferred payments for products isn’t a new strategy, in e-commerce, this concept is relatively new and has gained a lot of popularity in recent years. Part of the reason is due due to the supply chain issues that affected merchants worldwide during the pandemic, which still pose threats to inventory availability today. Another reason is that customers seek flexible payments when shopping online. A great example of this is the popularity of buy now, pay later solutions. In this comprehensive guide, we will explore deposits as a concept, delve into selling strategies that benefit from them, highlight industries where deposits are the norm, and provide guidance for creating successful deposit campaigns on Shopify.

What is a deposit?

Before we delve into the world of deposits on Shopify and how to use them, let’s first understand their significance. Deposits involve requesting a partial payment upfront from customers when they place an order. With sophisticated workflows, the remaining balance is also collected before the product is shipped to the customer. This approach offers various benefits for both businesses and consumers.

By requesting a deposit, you can secure customer commitment early and increase conversions for products that are not yet available. From the customer’s perspective, deposits build trust and loyalty, as they signal that the business they are purchasing from understands their financial needs and empathizes with them. This is especially valuable in tough economic times, such as recessions.

Selling strategies that benefit from deposits

Deposits and partial payments are a powerful strategy that can enhance a variety of selling strategies. Depending on your business type, deposits can help increase conversion rates, streamline inventory and demand management, improve logistics handling, and foster strong customer relationships.

Below, we have outlined several strategies that benefit from using deposits. We have also included guides to assist you in setting up your Shopify store with these strategies.

Made to order

What is made to order?

“Made-to-order” is a manufacturing strategy utilized by businesses across different industries from sustainable fashion to furniture makers. This strategy involves custom-making products and is valuable in reducing waste and avoiding dead stock. Typically, made-to-order products have a lead time that can vary from a few weeks to several months which makes deposits a must have for getting commitment from customers.

How can deposits help?

If your business specializes in customized or made-to-order products, deposits can play an instrumental role in managing inventory and production costs. By collecting a deposit upfront, you can ensure customer commitment while also covering expenses for materials and production. This approach allows you to streamline your operations and reduce the risk of excess inventory. Deposits also benefit your customers by making the product more affordable for them while they wait for their order to be ready.

Learn more about how Athena Gaia boosted their AOV by 25% by offering deposits as a form of payment for their hand made Greek jewelry.

Examples of made to order businesses

-

A furniture store offering made-to-order items with custom colors, finishes, sizes, etc. The price of these products varies based on the options selected by the customer, and the deposit required is usually 30-50% of the total cost. Check out our guide on setting up a furniture store on Shopify.

-

An artist offering commissioned paintings. In this case, deposits are typically non-refundable since the artwork is unique and significant to the specific buyer, making it difficult or impossible to resell.

How to set up deposits for your made to order business on Shopify

-

Sign up for Shopify and follow the simple onboarding to begin selling online.

-

Set up your products using Shopify’s “Adding and updating products” guide.

-

If your products have a lot of customizable options, you’ll likely reach the 100 variant limit with Shopify and will need to use a product options app such as Infinite Options or similar. Keep in mind, not all product options apps are compatible with taking deposits.

-

Once you’ve set up all of your products and the options, install Downpay to get started with using partial payments on your store. The onboarding guide will help take you through the initial setup and the creation of your first purchase option.

-

When creating your first deposit purchase option, we encourage using a percentage based deposit amount for accurate cart pricing and using: number of days after checkout for the release date so that the date is set based on when each customer is purchasing the product.

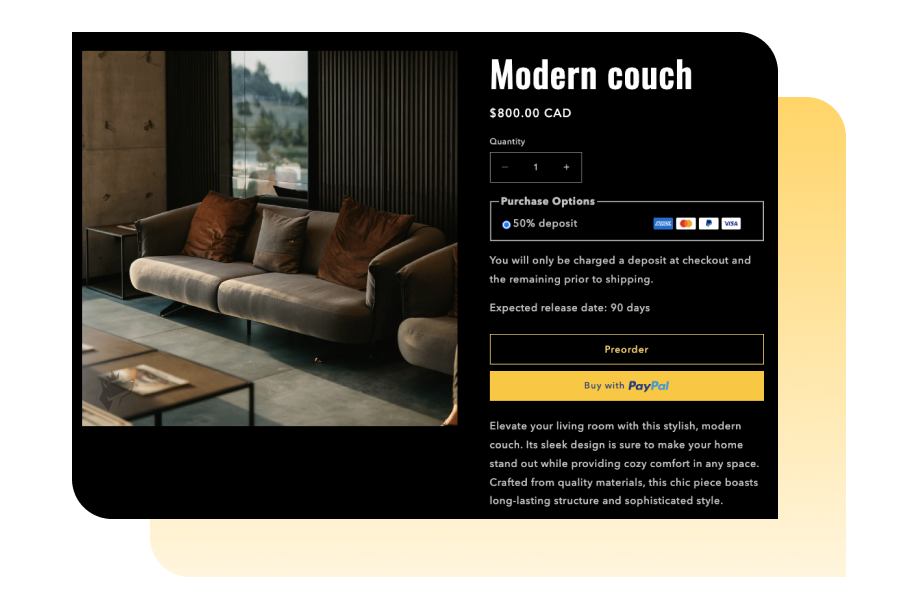

Preorders

What is a preorder?

A preorder is a selling strategy where a business generates buzz and offers a product for sale that is not available yet. Preorders help merchants gauge demand before a launch and plan production accordingly.

How can deposits help preorders?

By utilizing deposits for preorders, you can secure commitments from your customer base and have more confidence in the demand your product is generating. Preorders also create a sense of exclusivity and anticipation among customers, often including discounts and extra items for early adopters.

Examples of preorder businesses

-

A brand like Trashplanet launching a new sneaker and offering preorders to gauge demand.

-

A store offering upcoming board games and accepting preorders to determine how many to purchase from the manufacturer.

How to set up preorders on Shopify and offer deposits

Shopify’s preorder guide along with Downpay will help you run a successful preorder campaign.

B2B Wholesale

What is B2B Wholesale?

B2B (business-to-business) wholesale is a selling method where businesses sell their products in bulk to other businesses. In this strategy, customer relationships, invoicing, and price lists per customer are crucial. Partial payments play a significant role, especially when businesses sell goods with long delays or high order value. For an in depth guide into B2B Wholesale, check out Shopify’s guide on the topic.

How can deposits help with B2B Wholesale?

When conducting wholesale transactions, businesses often request a deposit to secure a large order. Deposits ensure a deep commitment to a particular purchase. Additionally, deposits enable businesses to manage their cash flow for high-value orders.

How to set up deposits for B2B Wholesale?

Although draft orders on Shopify currently don’t support native deposits with apps like Downpay, there are a few work-arounds you can use.

1. Use Shopify POS and Shopify admin to offer partial payment on draft orders. Note: This method will not store credit card information

Navigate to your Shopify admin and click on the Orders tab and then click the Create order button in the top right.

Add the products you wish to sell to the order and then check Payment due later and select Due on receipt and click Create Order at the bottom.

Open up POS on a mobile device, naviate to the orders tab and change the Sale Type filter to Online and find the draft order you just created and open it.

Click Collect payment and select Split payment and modify the initial amount you wish to collect and enter in the credit card or gift card information.

Go back into the Shopify admin dashboard and select the order again. It will now show up as Partially Paid.

Collect payment at a later date either through POS using the same method or through the Shopify admin by entering in a credit card.

2. Send two separate invoices: Create an invoice for the deposit and a second invoice once the order is ready to be shipped. Note: This will have inventory implications as there will be two invoices for the same product.

3. Use Shopify’s Online store store for wholesale with Shopify’s B2B guide and offer deposits with Downpay.

Reserve now, pay later

What is Reserve Now, Pay Later?

In many service industries, the use of reservations is quite common. When businesses have limited availability or want to foster customer commitment while gaining a competitive edge, they offer the option for customers to defer their payment to a later date. This strategy provides customers with peace of mind, particularly when booking appointments or purchasing trip packages with high costs.

How can deposits help with reserve now, pay later?

While this strategy doesn’t necessarily require an upfront deposit, the ability to charge no money at the time of booking while securely storing a payment method for future use is part of the unique set of tools offered by apps like Downpay. These tools extend the flexibility of how customers can make purchases online.

Examples of reserve now, pay later businesses

-

Hotels offering room books at no upfront cost and deferring payment until check-in.

-

Restaurants offering offering reservations by securely saving a credit card on file and charging a nominal fee incase of last-minute cancellations.

How to set up reserve now, pay later on Shopify and defer payment

-

Sign up for Shopify and follow the simple onboarding to begin selling online.

-

Set up your products using Shopify’s “Adding and updating products” guide.

-

Once you’ve set up all of your products and the options, install Downpay to get started with using deferred payments. The in app onboarding guide will help take you through the initial setup and the creation of your first purchase option.

-

Now that you’re ready to offer deferred payments on your products or services, simply select 0% or 0$ when setting a deposit amount.

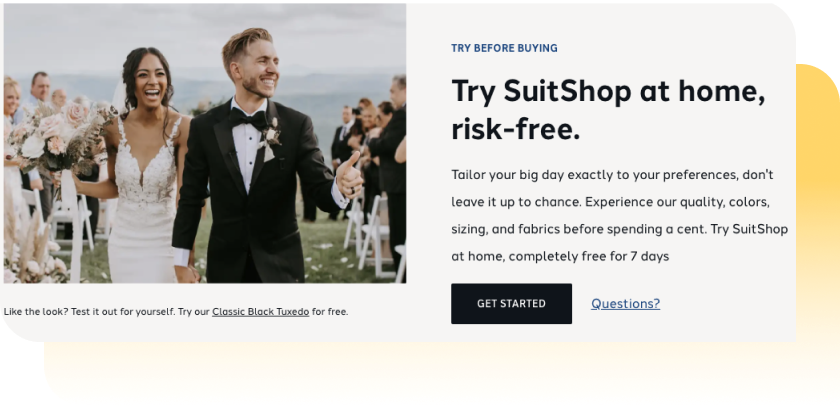

Try before you buy

What is try before you buy?

“Try before you buy” or “try now, pay later” is a strategy where customers have a trial period for a product they are interested in purchasing, without being charged at checkout. This selling strategy is particularly useful in encouraging customers to complete their purchase, especially when products come in different sizes and styles. Similar to the “reserve now, pay later” approach, products are offered with either a $0 upfront cost or a minimal shipping fee. The remaining payment is then deferred for a grace period, typically 7 to 10 days. After the grace period, if the customer has not initiated the return process, they will be charged the total cost of the product.

How can deposits help with try before you buy?

In this strategy, the ability to defer payment and automatically charge the total cost after the trial period is essential. By utilizing apps like Downpay, merchants can offer customers the opportunity to try a product with no upfront cost, while securely storing their payment method for automatic charging if they decide to keep the product after the trial period. This payment vault feature makes “try before you buy” a powerful technique to improve conversion rates and help customers feel more confident in their purchases, particularly when it comes to determining size and style preferences for products.

[To learn more about creating exceptional “try before you buy” experiences, check out this Shopify article]

Examples of try before you buy businesses

-

Revelry offer a home try on program in order to ensure customers can find their preferred size and style.

-

Suit Shop offers a program to allow customers to try their suits for 7 days before purchasing.

How to set up try before your buy on Shopify with deferred payment

-

Sign up for Shopify and follow the simple onboarding to begin selling online.

-

Set up your products using Shopify’s “Adding and updating products” guide.

-

Once you’ve set up all of your products and the options, install Downpay to begin using deferred payments. The in-app onboarding guide will assist you in the initial setup and creation of your first purchase option.

-

Now that you are ready to offer deferred payments on your products or services, simply select either 0% or $0 as the deposit amount. Additionally, you can continue to provide the Pay in full option for customers who prefer to purchase products outright.

-

When determining the release date, set a trial period for your customers using the Number of days after checkout option. We recommend selecting a period between 7 and 10 days to account for any potential shipping delays.

-

Consider integrating with an app that streamlines your return process, allowing customers to manage their orders more efficiently.

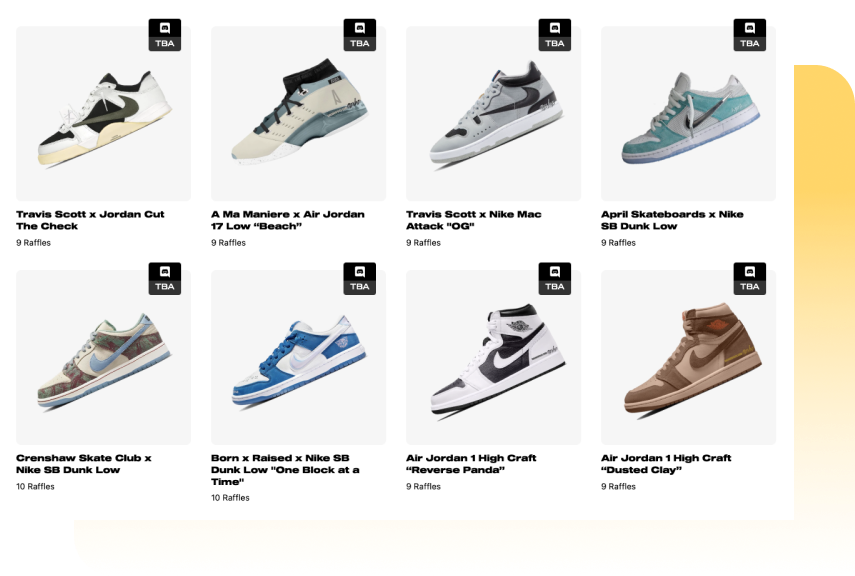

Raffles for limited drops

What is a raffle?

Merchants who have limited stock engage their buyers by offering loyal customers the opportunity to participate in a raffle for a chance to purchase the latest product. This strategy is particularly popular among merchants selling limited edition sneakers. Raffles also serve as a means for businesses to manage bot activity during limited drops.

How can deposits help raffles?

While waitlists and waiting rooms have gained popularity, they do not guarantee customer conversion. Offering a raffle and securely storing a customer’s payment method until the winners are selected can be a valuable tool to save customers from having to go through the checkout process again after the draw. This strategy also ensures that a merchant is not waiting for payment from a winner as some brands have a deadline provided by manufacturers that they must meet in order to continue receiving stock to sell.

Examples of raffles businesses

- An apparel store holding events for each of the new sneaker releases and offering customers a chance to purchase a limited pair.

Running raffles on Shopify with deposits

-

Sign up for Shopify and follow the simple onboarding to begin selling online.

-

Set up the product you want to offer as a raffle and save it as a draft. Refer to Shopify’s “Adding and updating products” guide.

-

Install Downpay to begin using deferred payments. The in-app onboarding guide will help you with the initial setup and creation of your first purchase option.

-

Create a new purchase option for the product you want to raffle and select either 0% or $0 as the deposit amount. Ensure the option to allow customers to pay in full is turned off.

-

Set the release date to the date when the raffle draw will take place.

-

Update the product description and information on your storefront, indicating that only selected customers will be charged the remaining payment if they are chosen as winners.

-

Once the draw is completed, collect payment from the winners through Shopify, and cancel all other orders.

Warning: These instructions will allow you to run raffles on Shopify however they may lead to difficult order management as potentially thousands of orders will be created and then have to be canceled for customers who participate but don’t win.

Dropshipping

What is dropshipping?

Dropshipping is a business model in which a merchant doesn’t stock the products they sell. Instead, they transfer customer orders and shipment details to a manufacturer, wholesaler, or another retailer, who then fulfills the order directly to the customer. This strategy is beneficial for merchants who don’t have the capital to invest in pre-purchasing inventory, making it more attainable to launch a store.

How can deposits help with dropshipping?

In certain cases, dropshipping can involve long delays associated with order fulfillment. Deposits become a valuable tool in managing customer expectations. By requesting a minimal deposit upfront while the customer waits, you can reduce the likelihood of order cancellations.

Examples of dropshipping businesses?

Dropshipping is a back-office strategy that businesses across a multitude of industries can utilize.

How to set up a dropshipping business with deposits

First, review Shopify’s guide to dropshipping and then use use Downpay’s core deposit functionality to offer deposits on each of your dropshipped products.

Industries where deposits are the norm

As mentioned, offering deposits is not a new selling strategy, and it has become a common practice in various industries. These industries have discovered several benefits of offering deposits, including reducing cancellations, fostering customer loyalty, and gauging demand to minimize waste and costs.

Here are some of the industries that have thrived with the use of deposits:

Home and Garden

Furniture manufacturers frequently require deposits for custom orders to cover production costs and ensure customer commitment. By collecting a deposit, furniture businesses can effectively plan their manufacturing processes, source materials, and allocate resources efficiently. Customers also expect deposits on high-value products like furniture, as it helps them manage payments more easily.

Check out our guide on How to sell custom made furniture on Shopify in 2023

Services

Many service-based businesses, such as professional consultants, freelancers, and event planners, commonly request deposits to secure bookings and effectively allocate resources. By collecting a deposit, service providers can ensure commitment from clients and protect themselves against last-minute cancellations.

Games and Toys

The gaming and toy industry often employs pre-order systems that allow customers to secure their copies of highly anticipated video game titles or the latest action figures by placing a deposit. This approach generates excitement among customers and helps stores gauge demand and manage production. Pre-orders for these kinds of products often come with incentives such as discounts, extra items, or limited edition offers thus encouraging customers to place orders early to secure their copy.

Farm Fresh Goods

Community-supported agriculture (CSA) programs and farm-to-table initiatives often require customers to pay a deposit to reserve their share of seasonal produce. Another example is farms raising animals for sale. Deposits ensure that orders are secured early, alleviating concerns for farmers about raised animals not finding a home. This approach helps farmers plan their harvests, manage logistics, and maintain a stable customer base.

Consumer electronics

Companies like Apple and Google frequently offer pre-orders for their latest phones to gauge demand and secure early sales. Devoted fans of their products appreciate the opportunity to be the first to secure an eagerly anticipated product.

These industries have effectively utilized deposits to their advantage, offering benefits to both businesses and customers.

Ways to create successful deposit campaigns

To ensure your deposit campaigns are effective and well-received by customers, there are various strategies you can implement and customize to suit your selling style.

Build hype early

Generate excitement and anticipation for your products by building hype in advance. Use social media, email marketing, and other channels to create buzz and inform your audience about upcoming preorder with deposit opportunities.

Writing a clear cancellation policy

Clearly communicate your cancellation policy to set expectations and address potential concerns. A well-defined cancellation policy builds trust and provides customers with peace of mind when making a deposit. For more guidance on setting up clear cancellation policies, refer to our detailed guide.

Communicating with Your Customers

Maintain regular communication with your customers regarding order progress, expected delivery dates, and any updates related to their deposits. Keeping customers informed builds transparency and trust, reducing anxiety and increasing satisfaction with their deposit experience.

Changing Language on Your Checkout Page

Optimize your checkout by using language that suits your business. Clearly define expected timelines and terms of the sale and use compelling copy and visually appealing design to create a seamless and trustworthy checkout experience.

Offering Incentives

Consider offering incentives to customers who choose to make a deposit, especially on unreleased products that are available for preorder. This could include exclusive discounts, early access to new products, or additional perks that make the deposit option more enticing. Incentives can motivate customers to take action and increase the success of your campaigns.

For more actionable tips and best practices on creating successful deposit campaigns, explore our dedicated article on the subject.

Use a variety of payment options to give customers more flexibility

Consider providing a range of payment options, including buy now, pay later and deposits, to give customers more flexibility in how they choose to complete their purchases. Offering multiple payment options can cater to different customer preferences and increase conversions.

Current limitations of deposits on Shopify

When using deposits on Shopify, it’s important to be aware of certain limitations:

-

Deposits are available for stores using Shopify Payments or Paypal.

-

Deposits are only available on the Online store channel, while native deposits can be used for Shopify POS following our guide.

-

Order editing supports removing a product with a deposit, but other modifications may not be supported.

-

Draft orders are not compatible with deposits.

-

Only one future payment collection is available for orders with deposits.

-

Buy now, pay later and subscription selling strategies do not support deposits but can be used together as seperate options.

-

Deposits don’t support “Buy x, get y” discounts.

Final thoughts

Running deposits on Shopify can be a game-changer for your business, offering advantages such as improved cash flow, reduced risk, and enhanced customer satisfaction. By leveraging the power of deposits, you can streamline your operations, manage inventory effectively, and provide a seamless purchasing experience for your customers, increasing conversion rates. To fully benefit from deposit functionality on Shopify, we recommend installing Downpay, an innovative Shopify app developed by Hypehound. With Downpay, you can easily enable deposit functionality for your store, streamline the payment process, and provide a frictionless experience for your customers.

Don’t miss out on the opportunity to boost your sales and enhance customer satisfaction. Install Downpay today and unlock the benefits of running deposits on your Shopify store.

Not sure if deposits is right for your business? Schedule a call with us and let’s chat

Diana Birsan

Co-founder, HypehoundHelping online brands sell more to their biggest fans.