Payment vaulting: How to use automatic payment collection for deposits on Shopify

Aug 10, 2023

For years, Shopify’s buying experience was optimized for “buy now, pay now”. Businesses who had inherent shipping delays for their products, like pre orders or custom made goods, struggled with this rigid buyer experience because it forced their customers to pay upfront. While buy now, pay later options like Klarna or Shop Pay Installments had been around for a while, they didn’t help businesses that had extended delivery times because payments started right away. Additionally, storing payment methods inside Shopify in order to charge customers later wasn’t possible in the early days. Enter payment vaulting – an innovative solution designed to revolutionize deposit collection and recurring charges in order to make the customer purchasing journey more flexible.

The creation of payment vaulting

In 2020, I joined the Subscriptions team at Shopify and embarked on transforming the platform to support recurring payments. After we released subscriptions functionality on Shopify, payment vaulting had come to life and app developers could enable their apps to use this tech in order to store a payment method on file. You can read more about the culmination of this work from Shopify’s blog article, “Shopify’s Subscription APIs: Build Apps That Integrate with Shopify Checkout”.

That same year, we were in the height of the pandemic and kept hearing about merchants struggling with supply chain delays. This inspired me to do something about it. During a quarterly “Hack Days” competition at Shopify, I rallied a team of 20 or so folks and worked to prototype running partial payments on Shopify using the same payment vaulting functionality. We wanted to offer merchants a way to take an initial deposit and charge the rest at a later date to a card on file. Only a couple months after the success of this experiment, we gained leadership alignment and built out a team to work on bringing the prototype to life. This functionality is now available and is at the core of what we built Downpay on. No more duplicate orders or products, or sending invoices manually, Downpay makes it easy to just vault a customer’s payment method until their order was ready.

Understanding Payment Vaulting

Let’s dive into exactly how collecting payment for a deposit works and why it’s so beneficial for not only merchants, but their customers as well.

Payment vaulting, currently exclusive to the Online Store, empowers merchants enable deposits and charge the remaining payment at a later date to a card on file. This revolutionary feature supports Shopify Payments and Paypal Express with automatic payments, with more gateways anticipated in the future.

Simple vaulting at checkout

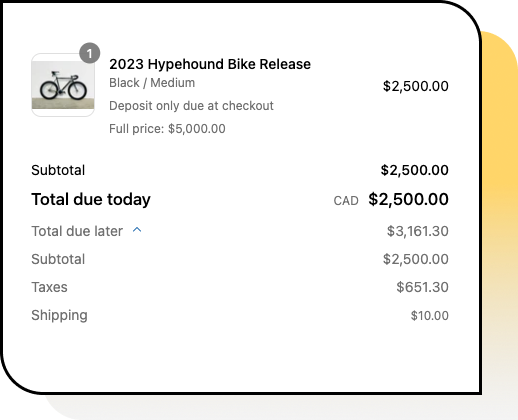

Customers opting for deposit purchases receive a clear breakdown of current and future charges during checkout. Shipping and taxes are also deferred for any order that only includes deposits.

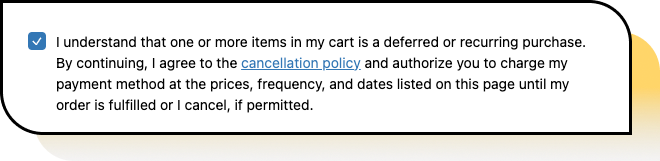

Next, in order to initiate payment vaulting, customers must agree to the store’s cancellation policy, a customizable message in Shopify’s policy settings.

Easy deposit order management

Once an order is placed, Shopify’s order management system categorizes orders as Partially paid and On Hold or Scheduled based on the type of release date that was set. A “collect payment” button enables easy payment collection, reducing the amount of steps when managing an order. Modifying payment due dates and notifying customers of changes is hassle-free with Downpay’s email notifications. When you’re ready to collect payment, it’s as simple as clicking “Charge” from the collect payment button and confirming. The order will then be marked as Paid and you’re ready to begin your fulfillment workflow.

Customer facing features

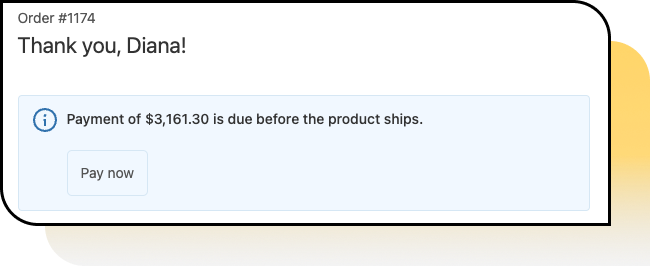

Payment vaulting also extends some control to customers. They can pay their remaining balances directly from their order status page, and in Downpay’s customer portal, they can change their payment method if they need. Merchants can also enable customer cancellations as an optional feature.

Simplify Deposits, boost conversions

Incorporating payment vaulting into your business with apps like Downpay not only streamlines deposit management but also elevates average order values (AOV) and conversion rates for selling strategies like made to order and preorders. By removing barriers associated with upfront payments, businesses can cater to a wider range of customers and encourage larger purchases.

Shopify’s payment vaulting has transformed the way deposits are managed. With enhanced checkout transparency, effortless order handling, and customer empowerment, this innovation enables Downpay to offer a seamless and flexible purchasing experience that feels like it’s just part of Shopify. Dive into the world of deposits and elevate your business with Downpay.

To read more on how deposits can be beneficial to different selling strategies, read more in our Ultimate Guide to Deposits.

What merchants are saying about Downpay

Our customers are already seeing an impact to their businesses when using deposits. Some stores have 70% of their orders processed as deposits and others, like Online Amish Furniture, have migrated back to Shopify Payments to gain the benefits of deposits with Downpay and the best converting checkout.

Try Downpay today

Not sure if deposits is right for your business? Schedule a call with us and let’s chat

Diana Birsan

Co-founder, HypehoundHelping online brands sell more to their biggest fans.